Best life insurance companies in Idaho include State Farm, Northwestern Mutual, and New York Life. Finding the right life insurance company is crucial.

Idaho offers several top-rated options, ensuring residents can secure their financial future. State Farm is known for its customer service and comprehensive policies. Northwestern Mutual offers tailored plans to fit diverse needs. New York Life has a strong reputation for reliability and financial stability.

Choosing the right provider involves comparing coverage options, premiums, and customer reviews. It’s essential to assess your personal needs and consult with an insurance agent. By doing so, you can ensure peace of mind and financial protection for your loved ones.

Introduction To Idaho’s Life Insurance Landscape

Idaho offers a diverse range of life insurance options. The state has many providers, each with unique plans. Understanding the landscape is crucial for making the right choice. This guide helps you navigate Idaho’s life insurance market.

Scope Of Life Insurance In Idaho

Life insurance in Idaho comes in various forms. These include term life, whole life, and universal life insurance. Each type serves different needs and budgets.

- Term Life Insurance: This is affordable and lasts for a set time.

- Whole Life Insurance: Offers lifelong coverage with a savings component.

- Universal Life Insurance: Provides flexible premiums and death benefits.

Factors To Consider When Choosing A Provider

Choosing the right provider involves several factors. It’s important to consider these aspects:

- Financial Stability: Check the company’s financial ratings.

- Customer Reviews: Read reviews to gauge customer satisfaction.

- Policy Options: Look for a variety of plans to suit your needs.

- Premium Costs: Compare premiums to find affordable options.

- Customer Service: Good support is essential for policyholders.

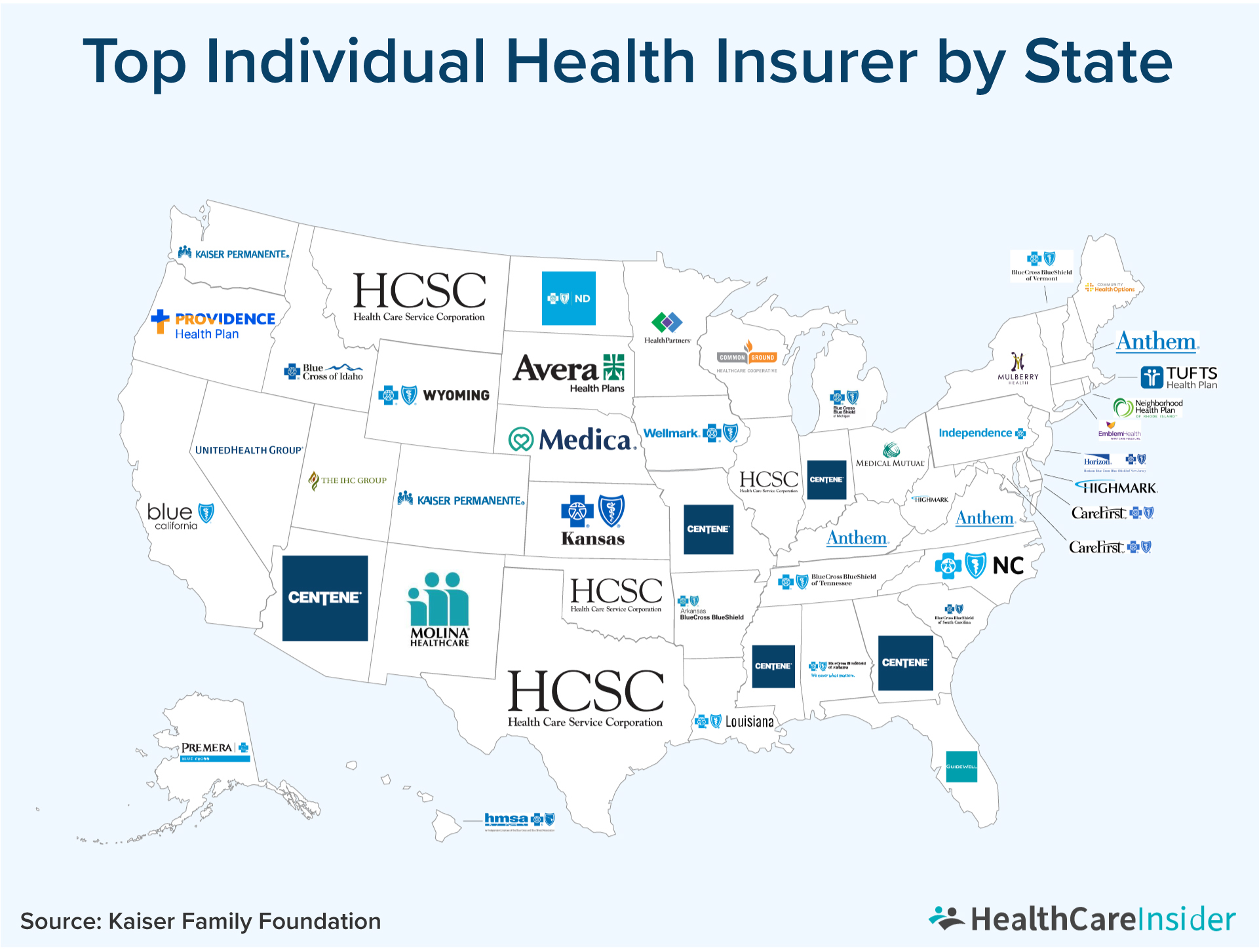

Credit: healthcareinsider.com

Criteria For Selecting Top Life Insurance Companies

Choosing the best life insurance company in Idaho requires careful consideration. It’s important to assess various factors to make an informed decision. This guide will help you understand the most crucial criteria for selecting top life insurance companies.

Financial Stability And Ratings

The financial stability of a life insurance company is critical. It ensures the company can meet its obligations. To assess financial stability, check the ratings from agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings reflect the company’s financial health and reliability.

| Rating Agency | Top Rating | What It Means |

|---|---|---|

| A.M. Best | A++ | Superior ability to meet obligations |

| Moody’s | Aaa | Highest quality, lowest credit risk |

| Standard & Poor’s | AAA | Extremely strong financial security |

Policy Options And Flexibility

It’s essential to examine the policy options a company offers. Different people have different needs. Look for companies that provide a wide range of options. These might include term life insurance, whole life insurance, and universal life insurance.

- Term Life Insurance: Covers you for a specific period.

- Whole Life Insurance: Provides lifelong coverage and a cash value component.

- Universal Life Insurance: Offers flexible premiums and death benefits.

Consider the flexibility of the policies. Some companies allow you to adjust your coverage as your needs change. This flexibility can be crucial for adapting to life’s unpredictable events.

Top Tier: Established Life Insurance Leaders

Finding the best life insurance company in Idaho can be challenging. To help, we’ve compiled a list of top-tier companies. These companies have a reputation for reliability and innovative coverage options.

Legacy Providers In Idaho

Several life insurance companies have been serving Idaho for decades. These legacy providers are known for their stability and customer satisfaction.

- Northwestern Mutual: Offers a range of life insurance plans. They have excellent customer service and financial strength.

- New York Life: Known for their whole life and term life policies. They have been in business for over 175 years.

- State Farm: Provides term, whole, and universal life insurance. They also offer customized plans.

Innovative Coverage Plans

Some companies in Idaho stand out for their innovative coverage options. These plans cater to unique needs and offer flexibility.

- Haven Life: Known for their online application process. They offer term life insurance with fast approvals.

- Ethos: Provides no-medical-exam policies. Their plans are affordable and easy to understand.

- Bestow: Specializes in term life insurance. They use technology to simplify the application process.

Choosing the right life insurance company in Idaho depends on your specific needs. Consider both legacy providers and those with innovative coverage plans. This ensures you get the best protection for your family.

Credit: www.jrcinsurancegroup.com

Rising Stars: New Entrants Shaping The Market

Idaho’s life insurance market is seeing exciting new players. These new entrants are changing how we view insurance. Their innovative approaches attract a new generation of policyholders.

Disruptive Models And Startups

Several startups are making waves in Idaho’s life insurance scene. They offer unique, disruptive models that simplify processes. Here are a few notable ones:

- BrightLife: Uses AI to customize policies for individuals.

- LifeEase: Simplifies the application process with an intuitive app.

- SecureFuture: Focuses on eco-friendly investment options.

These companies prioritize customer experience and provide transparent pricing. They also leverage technology to enhance user interaction.

Customer Satisfaction Scores

Customer satisfaction is crucial for these rising stars. They consistently receive high ratings for their user-friendly services. Below is a table showing their recent customer satisfaction scores:

| Company | Customer Satisfaction Score |

|---|---|

| BrightLife | 4.8/5 |

| LifeEase | 4.7/5 |

| SecureFuture | 4.9/5 |

These scores reflect their commitment to customer satisfaction. They ensure that policyholders have a seamless experience from start to finish.

Customer-centric Approach: Who Puts You First

Choosing the right life insurance company is crucial. A company’s customer-centric approach plays a key role. It shows how they value their clients. Companies with excellent customer service stand out. They make you feel secure and valued. Let’s dive into the best life insurance companies in Idaho. We’ll see who puts you first.

Comparing Customer Service Experiences

Customer service is vital in life insurance. Companies with strong customer service gain trust. They provide clear and helpful information. Let’s compare some top companies in Idaho.

| Company | Customer Service Rating | Special Features |

|---|---|---|

| Idaho Life Insurance Co. | ⭐⭐⭐⭐⭐ | 24/7 Support, Personalized Plans |

| Northwest Life Protection | ⭐⭐⭐⭐ | Dedicated Agents, Flexible Payments |

| Mountain Valley Insurance | ⭐⭐⭐⭐⭐ | Comprehensive Policies, Quick Claims |

Accessibility And Support

Accessibility means easy access to services. The best companies offer various support channels. This includes phone, email, and chat. Below are some examples.

- Idaho Life Insurance Co.: 24/7 phone and chat support.

- Northwest Life Protection: Email support with fast response times.

- Mountain Valley Insurance: Local offices for in-person help.

Accessibility and support are crucial. They ensure you get the help you need, when you need it.

Affordability: Balancing Cost And Quality

Finding the right life insurance in Idaho can be challenging. You need to balance cost and quality. Affordable life insurance should not mean poor service. Let’s explore how to achieve this balance.

Premium Structures And Fees

Understanding premium structures is crucial. Some companies offer fixed premiums. Others offer variable premiums based on age or health.

Fees can vary widely. Some plans have administration fees and policy charges. Make sure to read the fine print. Knowing these details helps you avoid hidden costs.

| Company | Premium Type | Fees |

|---|---|---|

| Company A | Fixed | $100/year |

| Company B | Variable | $50/year |

| Company C | Fixed | $75/year |

Value For Money Assessments

Assess the value for money. Look for benefits like coverage amounts and additional riders. A higher premium may offer better benefits.

Check customer reviews. Positive reviews often indicate good value and reliable service.

Compare the coverage with the cost. A balanced plan offers affordable premiums and comprehensive coverage.

- Compare coverage amounts

- Check for additional benefits

- Read customer reviews

Choosing the right life insurance in Idaho means balancing cost and quality. Use the tips above to find the best plan for you.

Navigating Policy Terms And Conditions

Choosing the right life insurance policy can be complex. Understanding the terms and conditions is crucial. This section will guide you through the essential aspects of policy terms. Learn about exclusions, limitations, and the flexibility in making adjustments to your policy.

Understanding Exclusions And Limitations

Every life insurance policy comes with exclusions and limitations. These are situations where the policy does not provide coverage. Common exclusions include:

- Death due to suicide within the first two years

- Death caused by criminal activities

- Death due to pre-existing medical conditions

Understanding these exclusions helps avoid surprises during claim times. Always read the fine print. Knowing what is not covered is just as important as knowing what is.

Flexibility In Policy Adjustments

Flexibility is a key feature in modern life insurance policies. Policies should adapt to changing life circumstances. Consider the following options:

- Policy conversion: Convert term life insurance to whole life insurance.

- Premium adjustments: Increase or decrease your premium payments as needed.

- Beneficiary changes: Update your beneficiaries at any time.

These options ensure your policy remains relevant. Always check if these adjustments are possible with your policy. Flexibility can be a significant advantage.

| Insurance Company | Policy Conversion | Premium Adjustments | Beneficiary Changes |

|---|---|---|---|

| Company A | Yes | Yes | Yes |

| Company B | No | Yes | Yes |

| Company C | Yes | No | Yes |

Refer to the table above to compare companies. Choose a policy that offers the flexibility you need.

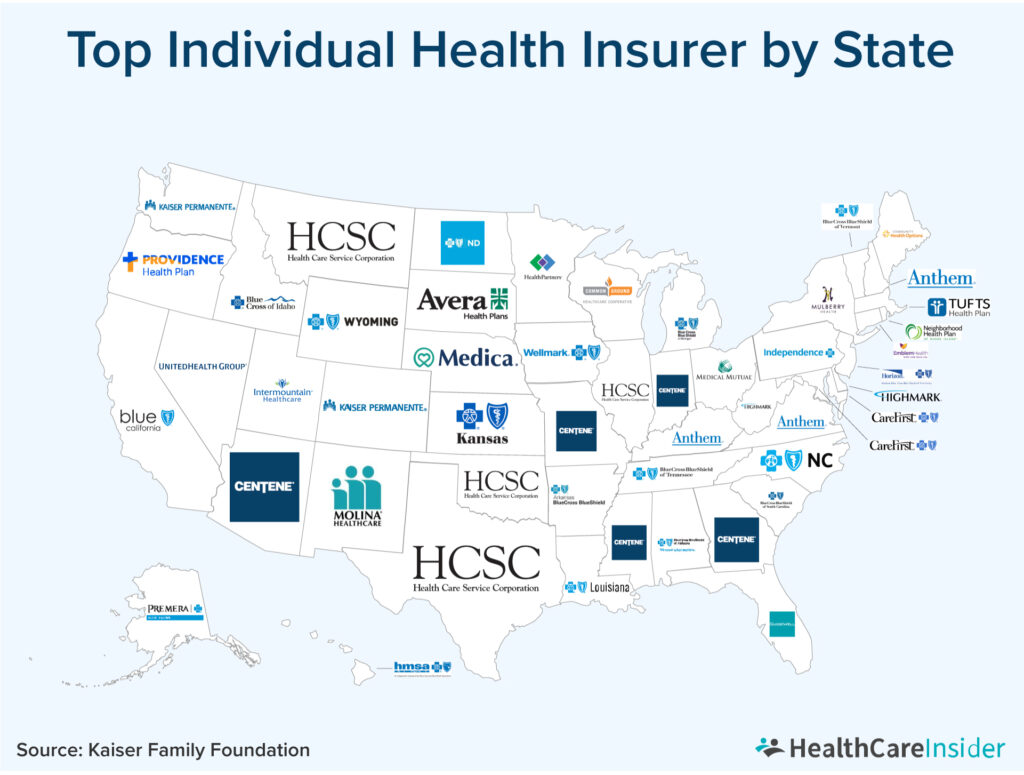

Credit: healthcareinsider.com

Making The Choice: Steps To Secure Your Life Insurance

Securing life insurance in Idaho is an important decision. It ensures financial stability for your family. Follow these steps to make the right choice.

Evaluating Your Insurance Needs

Evaluate your insurance needs before making a decision. Consider your family’s future expenses. Think about mortgages, education, and daily living costs.

Make a list of your current debts. Include loans, credit cards, and any other liabilities. This helps determine the coverage amount you need.

Consider your income replacement. How much will your family need if you are no longer there? Multiply your annual income by the number of years until retirement.

| Consideration | Details |

|---|---|

| Future Expenses | Mortgages, education, daily living costs |

| Current Debts | Loans, credit cards, other liabilities |

| Income Replacement | Annual income multiplied by years until retirement |

Finalizing The Purchase: What To Expect

Once you have evaluated your needs, it’s time to choose a policy. Research different life insurance companies in Idaho. Compare their offerings and read reviews.

Contact an agent to discuss your options. They can help tailor a policy to your needs. Ask about premiums, coverage, and any additional benefits.

Complete the application process. This may include a medical exam. Be honest and thorough in your responses.

- Research companies

- Contact an agent

- Discuss options

- Complete the application

- Undergo a medical exam

Review the policy details carefully. Ensure it meets your needs. Confirm the premium amount and payment schedule.

Sign the policy documents. Keep a copy in a safe place. Inform your family about the policy and where to find it.

Frequently Asked Questions

What Are The Top Life Insurance Companies In Idaho?

The top life insurance companies in Idaho include State Farm, Northwestern Mutual, and New York Life. These companies are well-regarded for their customer service and comprehensive coverage options.

How To Choose The Best Life Insurance In Idaho?

Choose the best life insurance by comparing policies, reading reviews, and considering your financial needs. It’s crucial to select a company with a good reputation and affordable premiums.

Are There Affordable Life Insurance Options In Idaho?

Yes, many companies offer affordable life insurance options in Idaho. Companies like State Farm and Allstate provide competitive rates and customizable policies to fit your budget.

Do Idaho Life Insurance Companies Offer Online Quotes?

Yes, most life insurance companies in Idaho offer online quotes. This allows you to compare different policies easily and find the best option for your needs.

Conclusion

Choosing the right life insurance company in Idaho is crucial. The best options offer reliability and customer satisfaction. Make an informed decision by comparing policies, coverage, and rates. Protect your family’s future today with the best life insurance provider in Idaho.

Your peace of mind is worth it.