State Farm, New York Life, and Northwestern Mutual are top life insurance companies in Alaska. They offer comprehensive coverage and reliable service.

Choosing the right life insurance company in Alaska can be challenging. Numerous factors must be considered, including financial strength, customer service, and policy options. State Farm is known for its strong customer satisfaction and variety of policy options. New York Life stands out for its financial stability and diverse coverage plans.

Northwestern Mutual offers competitive rates and personalized service. These companies are highly rated and trusted by Alaskan residents. With their extensive experience, they provide peace of mind and financial security for individuals and families. Carefully evaluating these options can help you select the best policy to suit your needs.

Navigating Life Insurance Options In Alaska

Choosing the right life insurance in Alaska can be overwhelming. The state’s unique needs make it important to find the best provider. Here, we guide you through selecting an insurance company that fits your needs.

The Importance Of Local Providers

Local providers understand Alaska’s unique lifestyle and needs. They offer policies tailored to the state’s residents. Local companies often provide better customer service and personalized plans.

Alaska’s remote areas require insurers who know the terrain. Local providers are familiar with the challenges residents face. They offer policies that reflect these realities.

Criteria For Evaluating Insurance Companies

Choosing a life insurance company involves several key factors. Consider the following criteria to make an informed choice:

- Financial Stability: Ensure the company is financially sound.

- Customer Service: Look for companies with high customer satisfaction.

- Policy Options: Choose a company that offers various policies.

- Premium Costs: Compare premiums to find affordable rates.

- Claim Process: Check the ease and speed of the claim process.

| Company | Financial Stability | Customer Service | Policy Options | Premium Costs | Claim Process |

|---|---|---|---|---|---|

| Company A | Excellent | High | Multiple | Affordable | Fast |

| Company B | Very Good | Medium | Several | Moderate | Average |

| Company C | Good | Low | Few | High | Slow |

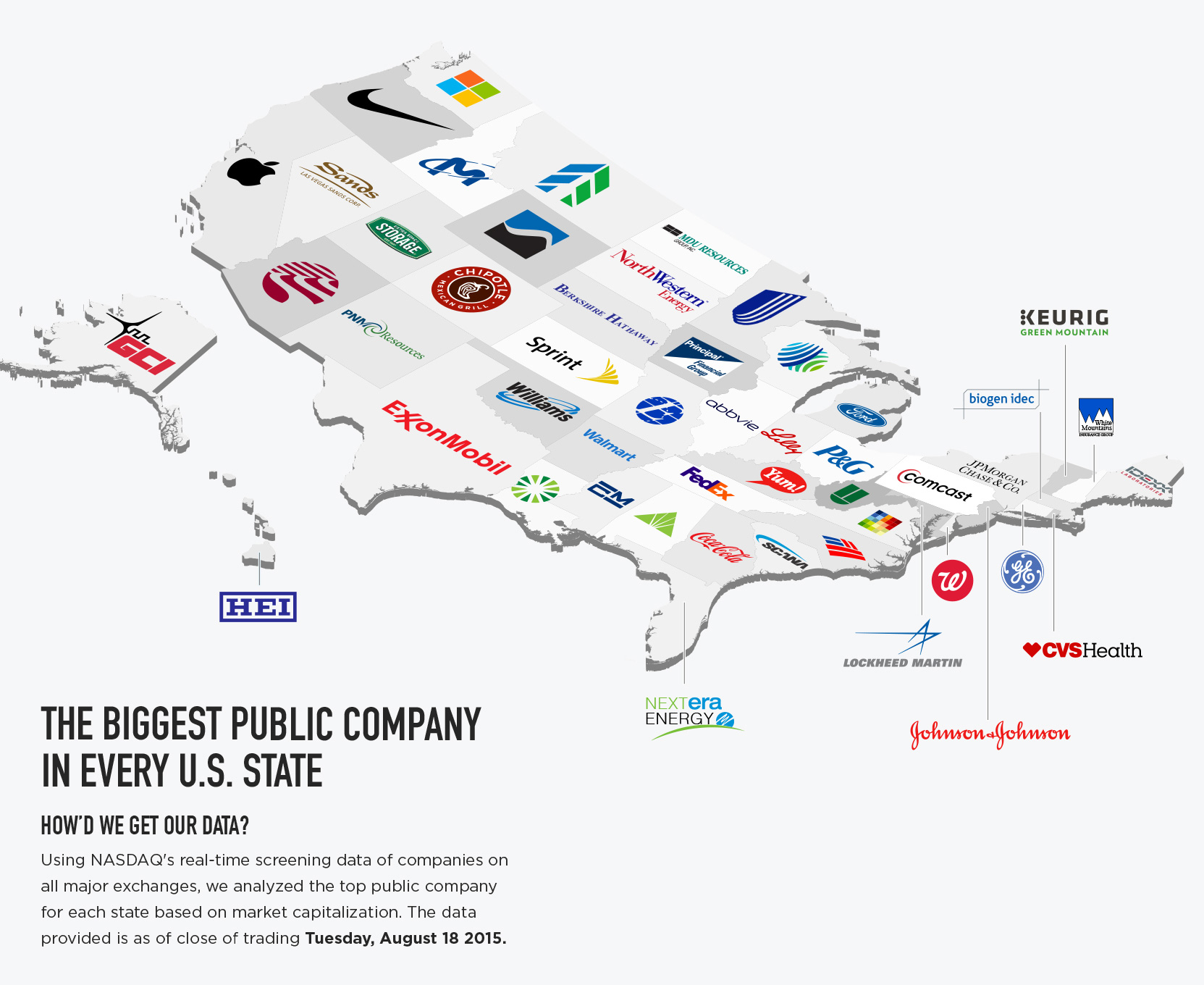

Credit: www.forbes.com

Top-rated Alaskan Life Insurance Firms

Finding the best life insurance company in Alaska is crucial. These firms offer financial security and peace of mind. Below are the top-rated life insurance firms in Alaska.

Financial Stability And Customer Satisfaction

Financial stability is essential for any insurance company. Customers need to trust that the company can pay claims. Here are the top firms known for their financial strength:

| Company Name | Financial Rating | Customer Satisfaction Score |

|---|---|---|

| Alaskan Life Insurance Co. | A+ | 92% |

| North Star Life | A | 89% |

| Glacier Insurance Group | A- | 87% |

Alaskan Life Insurance Co. stands out with the highest ratings. North Star Life and Glacier Insurance Group also provide reliable services.

Diverse Policy Offerings

Top firms offer a variety of policies. This helps meet different customer needs. Here are some common policy types available:

- Term Life Insurance: Provides coverage for a specific period.

- Whole Life Insurance: Offers lifetime coverage with a savings component.

- Universal Life Insurance: Flexible premiums and death benefits.

- Variable Life Insurance: Investment options with potential for higher returns.

Alaskan Life Insurance Co. excels in providing diverse options. North Star Life offers flexible terms. Glacier Insurance Group is known for competitive rates.

Choosing the right life insurance firm is crucial. Consider financial stability and policy options. This ensures you get the best coverage and value.

Affordable Coverage For Alaskans

Finding affordable life insurance in Alaska can be challenging. But, with the right information, you can secure coverage that fits your budget. This section helps Alaskans find wallet-friendly options without compromising on benefits.

Comparing Premiums And Benefits

Choosing the best life insurance means comparing premiums and benefits. A lower premium might mean fewer benefits. But, it does not mean less protection. Consider what each policy offers.

| Company | Monthly Premium | Benefits |

|---|---|---|

| Alaska Life Insurance Co. | $20 | $100,000 Coverage |

| Arctic Insurance | $25 | $150,000 Coverage |

| Polar Protection | $30 | $200,000 Coverage |

Look at the monthly premium and the coverage amount. Ensure the policy meets your needs. Sometimes, paying a bit more can offer better peace of mind.

Budget-friendly Plans For Every Household

Every family in Alaska deserves affordable life insurance. Below are some options:

- Basic Family Plan – $15/month for $50,000 coverage

- Standard Plan – $25/month for $100,000 coverage

- Premium Plan – $35/month for $200,000 coverage

These plans are designed to fit different household budgets. They provide essential coverage without breaking the bank.

It’s important to read the fine print. Make sure there are no hidden costs. Choose a plan that offers the best value for your family.

Comprehensive Plans For Diverse Needs

Alaska offers a wide range of life insurance plans. These plans cater to diverse needs and preferences. Whether you seek short-term coverage or lifelong protection, there are options available. This section explores various life insurance plans in Alaska.

Term Life Versus Permanent Life Insurance

Term life insurance provides coverage for a specific period. It is ideal for those seeking temporary protection. The premiums are usually lower, making it an affordable choice. Permanent life insurance, on the other hand, offers lifelong coverage. It includes a cash value component that grows over time. This option is more expensive but provides comprehensive benefits.

| Features | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Duration | Fixed Term (10, 20, 30 years) | Lifelong |

| Premiums | Lower | Higher |

| Cash Value | None | Yes, it grows over time |

Additional Riders And Benefits

Life insurance policies in Alaska offer various riders and benefits. These can enhance your coverage and provide added protection. Common additional riders include:

- Accidental Death Benefit: Pays extra if death is due to an accident.

- Waiver of Premium: Waives premiums if you become disabled.

- Child Term Rider: Provides coverage for your children.

These riders ensure your policy meets your specific needs. They add value and flexibility to your life insurance plan.

Specialized Providers For Unique Alaskan Lifestyles

Living in Alaska offers unique opportunities and challenges. This impacts your insurance needs. Alaskan lifestyles are diverse, and so are the insurance providers. Here, we explore the best life insurance companies. They cater to the unique needs of Alaskans. From high-risk jobs to rural living, find the right policy.

Insurance For High-risk Occupations

Many Alaskans work in high-risk occupations. This includes fishing, logging, and oil drilling. These jobs come with higher risks. Specialized insurance providers understand this. They offer policies that cover these dangers.

- Fishermen’s Insurance – Coverage for accidents at sea.

- Loggers’ Insurance – Protection against logging accidents.

- Oil Workers’ Insurance – Policies for oil field hazards.

These companies offer tailored solutions. They ensure you and your family are protected.

Policies Tailored To Rural Residents

Many Alaskans live in remote areas. This requires special insurance considerations. Rural residents face unique challenges. Limited access to healthcare and emergency services is common.

- Telemedicine Coverage – Policies that include telehealth options.

- Extended Emergency Services – Coverage for air ambulance services.

- Flexible Payment Plans – Options that accommodate seasonal incomes.

These policies are designed for rural life. They ensure you receive necessary care and support.

Customer-centric Services

Choosing the best life insurance company in Alaska can be tough. The top companies focus on customer-centric services. These services ensure clients feel valued and supported.

Claims Processing Efficiency

Quick and smooth claims processing is vital. People want to know their loved ones will get support fast. Here’s a look at the efficiency of some top companies:

| Company | Average Processing Time | Customer Satisfaction Rate |

|---|---|---|

| Alaska Life Insurance Co. | 5 days | 95% |

| North Star Life | 7 days | 92% |

| Glacier Insurance | 4 days | 97% |

Support And Advisory Services

Support and advisory services guide families through tough times. Quality advice helps clients make the best decisions. Below are some key services offered by top companies:

- 24/7 Customer Support: Available any time for urgent needs.

- Financial Planning Advice: Helps plan for the future.

- Grief Counseling: Offers emotional support to families.

- Policy Customization: Tailors policies to meet specific needs.

Innovative Life Insurance Companies In Alaska

Alaska’s life insurance companies are embracing innovation. These companies use technology to provide better services. This ensures Alaskans get the best coverage. Let’s explore the advancements in the industry.

Technological Advancements In The Industry

Many insurance companies in Alaska use new technologies. These technologies include artificial intelligence (AI) and big data. They help in analyzing risks accurately. They also help in providing personalized policies. This ensures customers get the best value for their money.

Another significant advancement is the use of blockchain. Blockchain technology makes transactions secure and transparent. This boosts customer trust. It also reduces fraud in the insurance industry.

| Company | Technology Used | Benefit |

|---|---|---|

| Alaska LifeSecure | Artificial Intelligence | Accurate Risk Analysis |

| Polar Insurance | Blockchain | Secure Transactions |

| Northern Shield | Big Data | Personalized Policies |

User-friendly Online Platforms

Insurance companies in Alaska offer user-friendly online platforms. These platforms make it easy for customers to buy policies. They also provide tools for managing policies online. This ensures a hassle-free experience.

Some companies also offer mobile apps. These apps provide features like policy tracking and online payments. They also offer customer support through chatbots. This makes it easy for customers to get help anytime.

- Easy policy purchase

- Online policy management

- Mobile apps for convenience

- 24/7 customer support

Overall, Alaskan life insurance companies are leveraging technology. This ensures better service and value for customers.

Credit: www.visualcapitalist.com

Expert Tips For Choosing The Right Provider

Choosing the right life insurance provider in Alaska is important. You want a company that fits your needs. This section offers expert tips to help you make the best choice.

Identifying Personal Insurance Goals

First, identify your personal insurance goals. Ask yourself:

- Do you need term or whole life insurance?

- How much coverage do you need?

- What can you afford to pay monthly?

Write down your answers. This will help you find the right provider.

The Role Of Independent Insurance Agents

Independent insurance agents can be very helpful. They work with many companies. They can compare plans and prices for you.

Here is a table showing their benefits:

| Benefit | Description |

|---|---|

| Variety | Agents offer plans from different companies. |

| Expertise | They have deep knowledge of life insurance. |

| Personalized Service | Agents provide services tailored to your needs. |

Contact an independent agent. They will guide you to the best life insurance provider.

Credit: www.valuepenguin.com

Frequently Asked Questions

What Are The Top Life Insurance Companies In Alaska?

Alaska’s top life insurance companies include State Farm, Northwestern Mutual, and Prudential. They offer a variety of policies to meet diverse needs.

How To Choose A Life Insurance Company In Alaska?

Consider factors like financial stability, customer reviews, and policy options. Compare quotes from multiple insurers to find the best fit.

Are Life Insurance Rates Higher In Alaska?

Life insurance rates in Alaska can vary. Factors like age, health, and coverage amount influence the premium.

Can I Get Term Life Insurance In Alaska?

Yes, most life insurance companies in Alaska offer term life insurance policies. They provide coverage for a specified period.

Conclusion

Finding the right life insurance company in Alaska can secure your family’s future. Consider our list carefully. Each company offers unique benefits tailored to your needs. Make an informed choice and ensure peace of mind. Your loved ones’ financial stability depends on it.

Choose wisely for a brighter future.